prince william county real estate tax payments

You can pay a bill without logging in using this screen. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Payment by e-check is a free service.

. A convenience fee is added to payments by credit or debit card. The County bills and collects tax payments directly from these companies. 1-888-272-9829 enter code 1036.

Occasionally the billing information on file is incorrect and a real estate tax bill that should have been sent to a. I havent received my property tax bill yet. Please contact Taxpayer Services at 703-792-6710 M-F 8 AM 5 PM.

Then they get the assessed value by multiplying the. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. Proceso de pago en espanol.

By creating an account you will have access to balance and account information notifications etc. Correspondence and Tax Payments. Contact the Real Estate Assessments Office Available M.

Teléfono 1-800-487-4567 entrando código 1036. Click here pay online. Certain types of Tax Records are available to the.

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. Prince William County Virginia Home. Who do I contact to get one in Virginia County Prince William.

How The Payment Process. How property tax calculated in pwc. A collection fee of 30 is added to accounts for more than 30 days delinquent.

Real estate tax funds are the lynchpin of local neighborhood budgets. Prince William County Virginia Property Tax Go To Different County 340200 Avg. Theyre a revenue mainstay for governmental services.

Prince William County Tax Administration Division PO Box 2467 Woodbridge VA 22195-2467. If you have questions about this site please email the Real Estate. Click here to register for an.

In Prince William County. Search 703 792-6000 TTY. Payment of the Personal.

Who do I contact to get one in Virginia County Prince William. Hi the county assesses a land value and an improvements value to get a total value. 09 of home value Yearly median tax in Prince William County The median property tax in Prince.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and. What Are Prince William County Real Estate Taxes Used For. All you need is your tax account number and your checkbook or credit card.

This estimation determines how much youll pay. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct. Make checks payable to Prince.

Job Opportunities Prince William County

Cheap Houses For Sale In Prince William County Va Point2

Prince William County Housing First Time Homebuyer Program Youtube

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County Va News Wtop News

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

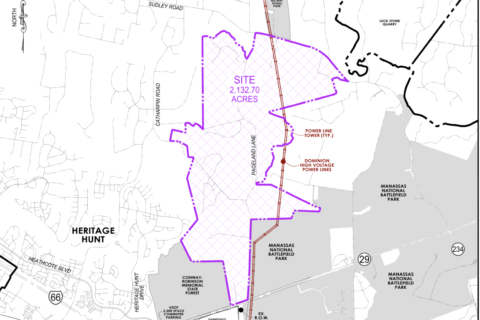

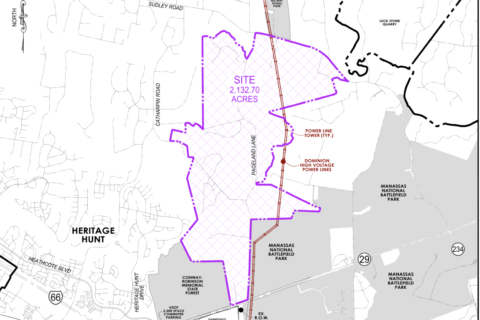

The Rural Area In Prince William County

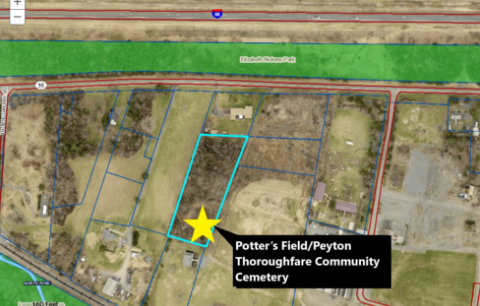

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Personal Property Taxes For Prince William Residents Due October 5

Around Prince William What Happened To The Harleys News Prince William Insidenova Com